- #HOW TO IMPORT 1099 INTO TURBOTAX FREE ONLINE FOR FREE#

- #HOW TO IMPORT 1099 INTO TURBOTAX FREE ONLINE HOW TO#

- #HOW TO IMPORT 1099 INTO TURBOTAX FREE ONLINE FULL#

That’s why we recommend using CryptoTrader.Tax. If you use additional cryptocurrency wallets, exchanges, DeFi protocols, or other platforms, Kraken can't provide complete gains, losses, and income tax information. Kraken’s reporting can only extend as far as the Kraken platform. In addition to trading on Kraken, they may conduct additional trades on other exchanges or use self-custodied wallets. Many cryptocurrency investors use additional exchanges, wallets, and platforms outside of Kraken.

#HOW TO IMPORT 1099 INTO TURBOTAX FREE ONLINE FULL#

There’s a reason why Kraken and other cryptocurrency exchanges struggle to provide full tax reporting for their customers.

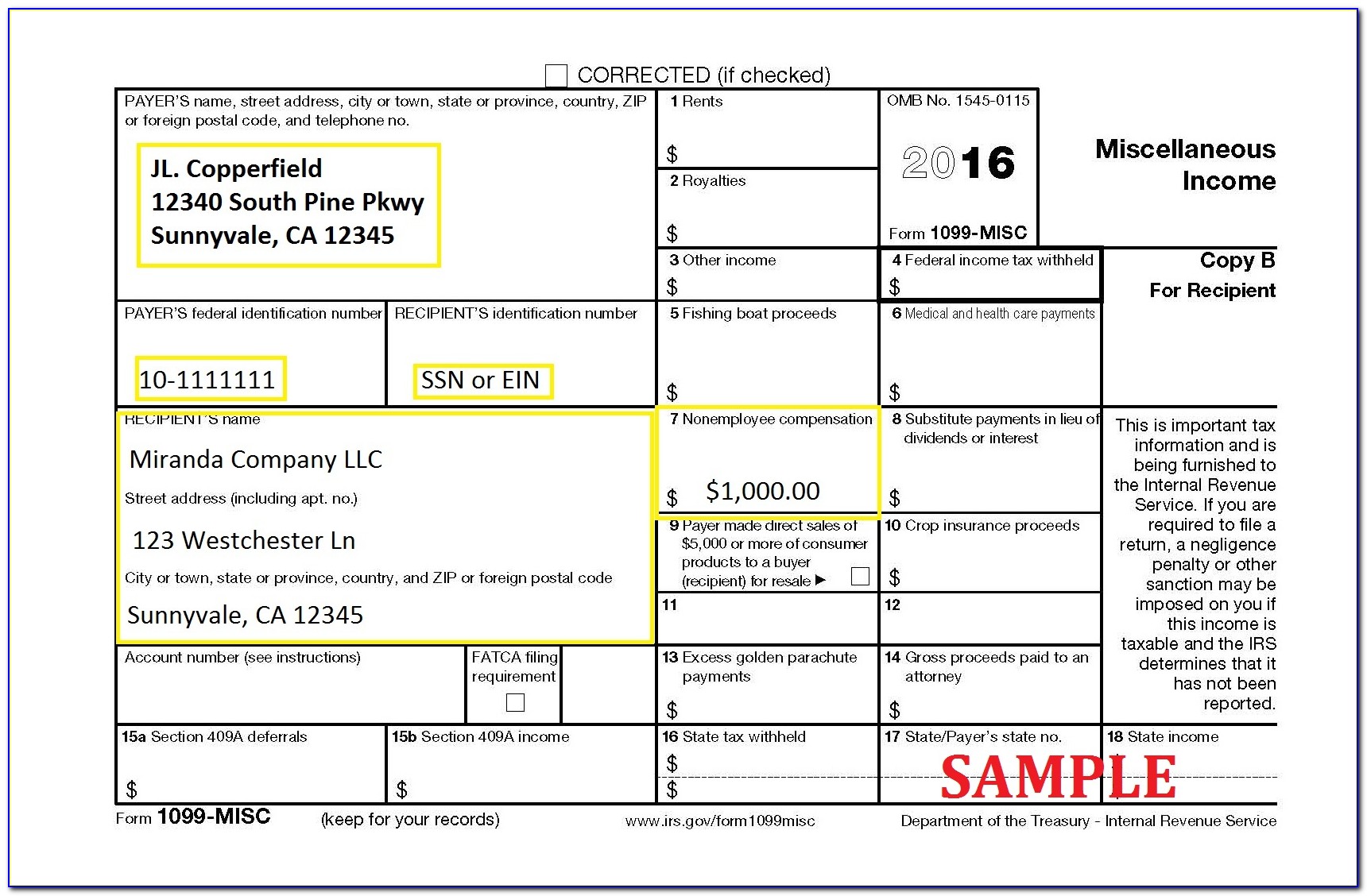

Why doesn’t Kraken generate my tax forms for me? In the future, Kraken will also be sending out 1099’s that report on your cryptocurrency transactions to the IRS as a result of the U.S. Kraken sends data on users with more than $20,000 in transaction volume to the IRS.

#HOW TO IMPORT 1099 INTO TURBOTAX FREE ONLINE HOW TO#

If you’re based in the United States, you can learn which forms you need to fill out in our blog post: How to Report Cryptocurrency On Your Taxes. Once you have your calculations, you can fill out the necessary tax forms required by your country. To do this, you’ll need data on all of the cryptocurrency transactions you’ve been involved with on Kraken and on any other exchange you’ve interacted with. To do your cryptocurrency taxes, you need to calculate your gains, losses, and income from your cryptocurrency investments in your home fiat currency (e.g.

How do I calculate my cryptocurrency taxes on Kraken? In 2021, it was estimated that Kraken had more than 6 million users and was the fifth-largest exchange in the world by transaction volume. Originally founded in 2011, Kraken is one of the largest US-based cryptocurrency exchanges. Let’s break down how you can accurately report all of your Kraken transactions to the IRS. Luckily, Kraken customers can still stay compliant with IRS guidelines - provided they take the right steps to stay on top of their transactions. Unfortunately, this can be challenging due to the transferable nature of cryptocurrencies. If you’re using Kraken to trade cryptocurrency, you need to report that activity on your taxes. Learn more about how CryptoTrader.Tax works here.

#HOW TO IMPORT 1099 INTO TURBOTAX FREE ONLINE FOR FREE#

You can test out the software and generate a preview of your gains and losses completely for free by creating an account. How Does Cryptocurrency Tax Software Help?īy integrating with all of your cryptocurrency platforms and consolidating your crypto data, CryptoTrader.Tax is able to track your profits, losses, and income and generate accurate tax reports in a matter of minutes.

If you use additional cryptocurrency wallets, exchanges, DeFi protocols, or other platforms outside of Kraken, Kraken can't provide complete gains, losses, and income tax information. The trouble with Kraken's reporting is that it only extends as far as the Kraken platform. Perhaps you also trade on Coinbase or earn interest from BlockFi. If you are in the United States, you can learn which forms you need to fill out with our blog post: How to Report Cryptocurrency On Your Taxes.

Just like these other forms of property, cryptocurrencies are subject to capital gains and losses rules, and you need to report your gains, losses, and income generated from your crypto investments on your taxes.įor a complete and in-depth overview, please refer to our Complete Guide to Cryptocurrency Taxes. Other forms of property that you may be familiar with include stocks, bonds, and real-estate. Cryptocurrencies like bitcoin are treated as property by many governments around the world-including the U.S.

0 kommentar(er)

0 kommentar(er)